Best Bonus Credit Cards

I'm a big fan utilizing credit cards that pay me perks to make purchases I'd be making anyways. I pay off all my cards every month, so I don't have to deal with the downsides of credit (the exceptionally high interest rates and fees). I also have a good deal of self control and don't allow myself to fall into the trap of putting purchases on a card if I can't afford to pay for the purchase. If you don't have the self control to pass on a purchase you can't afford even though you technically could buy it on credit, this approach might not be a winning strategy for you. Also, using online bill pay with your bank is highly recommended so you're not stuck writing out 4-5 checks every month and associated postage.

There are 4 credit cards that I generally use:

- American Express Blue Cash Preferred

-

- Perks:

-

- 6% (yes, 6%) back off of grocery store purchases (up to $6k)

- 3% off Gas

- 3% off of select Dept Stores (e.g Kohls)

- it also has a 1% back on everything else, but I never utilize this

- Cons:

- This one actually has a $75 annual fee. However, if you spend more than $1250 a year at a grocery store, the 6% cash back pays for the cost of the card.

- Huntington Voice Mastercard

-

- Perks:

-

- 3% back on a category of your choice that you can change every quarter. I have choosen Travel and Entertainment, and buy movie, Broadway, ballet, concert and other tickets with it. Other categories include Walmart, utilities, discount stores, department/electronics stores, restaurants, pharmacy, home improvement, gas.

- Chase Amazon Visa Card

-

- Perks:

-

- 3% back from Amazon purchases

- 2% back from gas (I use the AMEX blue for gas though), restaurants, drugstores, office supplies

- 1% everything else

- Fidelity Investment Rewards American Express

-

This is my "default" card that I use if I am buying something from a place that doesn't fit into one of the more specialized buckets (like groceries or gas) that has a better return.

- Perks:

-

- 2% back from all purchases when points are deposited into my Fidelity brokerage account

- Cons:

-

- Using an AMEX card as my "default card" is sometimes annoying, as there are places that don't accept AMEX. In that case, I simply switch to using the Amazon Visa and get the 1%.

- Under consideration: Citi Double Cash Card

- I've been pointed to this card as one possibly worth considering. It looks like it provides a 2% cash back reward, which puts it on par with the Fidelity Amex I currently have; however, since it would be either a Mastercard or Visa, it would avoid the whole "Amex isn't accepted here" problem I've had with my current "default card". Ideally, if it were a Visa, it'd allow me to leave the Amazon card at home, and carry just the Amex Blue, the Huntington Mastercard, and the Citi Visa and receive all the benefits I currently have carrying 4 cards.

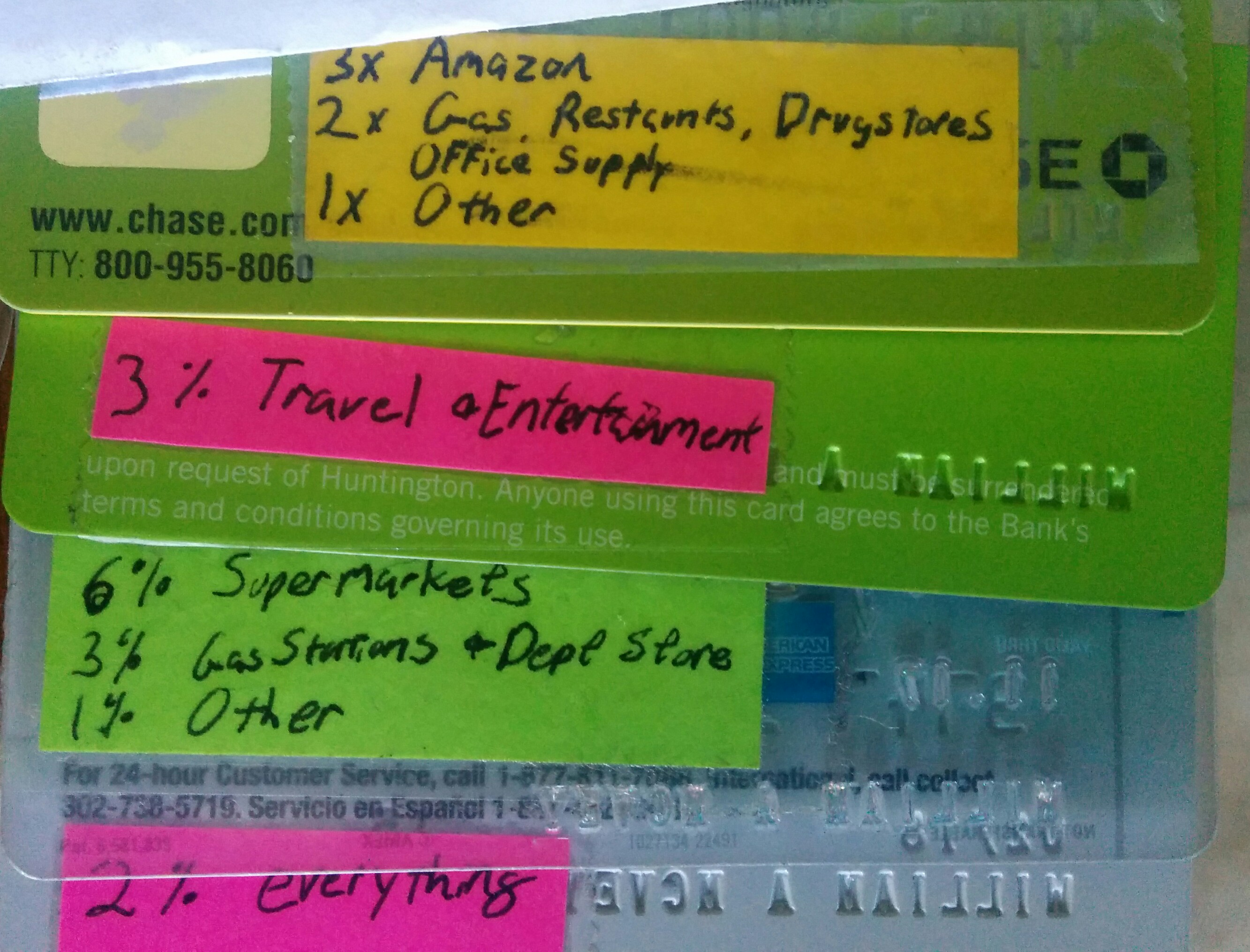

Keeping track of what card provides which bonus might be confusing if I had to keep track of it in my head. To avoid this, I simply let the card itself remind me what it is to be used for using some paper that gets taped to the card.

Any cards you guys like that I missed? I know some people make good use out of airline point cards to buy flights. This can perhaps score a higher return, but I just don't buy enough airline flights to really put this perk to good use.

More articles coming in my series of personal finance topics.