Wam's Ramblings

Best Bonus Credit Cards

I'm a big fan utilizing credit cards that pay me perks to make purchases I'd be making anyways. I pay off all my cards every month, so I don't have to deal with the downsides of credit (the exceptionally high interest rates and fees). I also have a good deal of self control and don't allow myself to fall into the trap of putting purchases on a card if I can't afford to pay for the purchase. If you don't have the self control to pass on a purchase you can't afford even though you technically could buy it on credit, this approach might not be a winning strategy for you. Also, using online bill pay with your bank is highly recommended so you're not stuck writing out 4-5 checks every month and associated postage.

There are 4 credit cards that I generally use:

- American Express Blue Cash Preferred

-

- Perks:

-

- 6% (yes, 6%) back off of grocery store purchases (up to $6k)

- 3% off Gas

- 3% off of select Dept Stores (e.g Kohls)

- it also has a 1% back on everything else, but I never utilize this

- Cons:

- This one actually has a $75 annual fee. However, if you spend more than $1250 a year at a grocery store, the 6% cash back pays for the cost of the card.

- Huntington Voice Mastercard

-

- Perks:

-

- 3% back on a category of your choice that you can change every quarter. I have choosen Travel and Entertainment, and buy movie, Broadway, ballet, concert and other tickets with it. Other categories include Walmart, utilities, discount stores, department/electronics stores, restaurants, pharmacy, home improvement, gas.

- Chase Amazon Visa Card

-

- Perks:

-

- 3% back from Amazon purchases

- 2% back from gas (I use the AMEX blue for gas though), restaurants, drugstores, office supplies

- 1% everything else

- Fidelity Investment Rewards American Express

-

This is my "default" card that I use if I am buying something from a place that doesn't fit into one of the more specialized buckets (like groceries or gas) that has a better return.

- Perks:

-

- 2% back from all purchases when points are deposited into my Fidelity brokerage account

- Cons:

-

- Using an AMEX card as my "default card" is sometimes annoying, as there are places that don't accept AMEX. In that case, I simply switch to using the Amazon Visa and get the 1%.

- Under consideration: Citi Double Cash Card

- I've been pointed to this card as one possibly worth considering. It looks like it provides a 2% cash back reward, which puts it on par with the Fidelity Amex I currently have; however, since it would be either a Mastercard or Visa, it would avoid the whole "Amex isn't accepted here" problem I've had with my current "default card". Ideally, if it were a Visa, it'd allow me to leave the Amazon card at home, and carry just the Amex Blue, the Huntington Mastercard, and the Citi Visa and receive all the benefits I currently have carrying 4 cards.

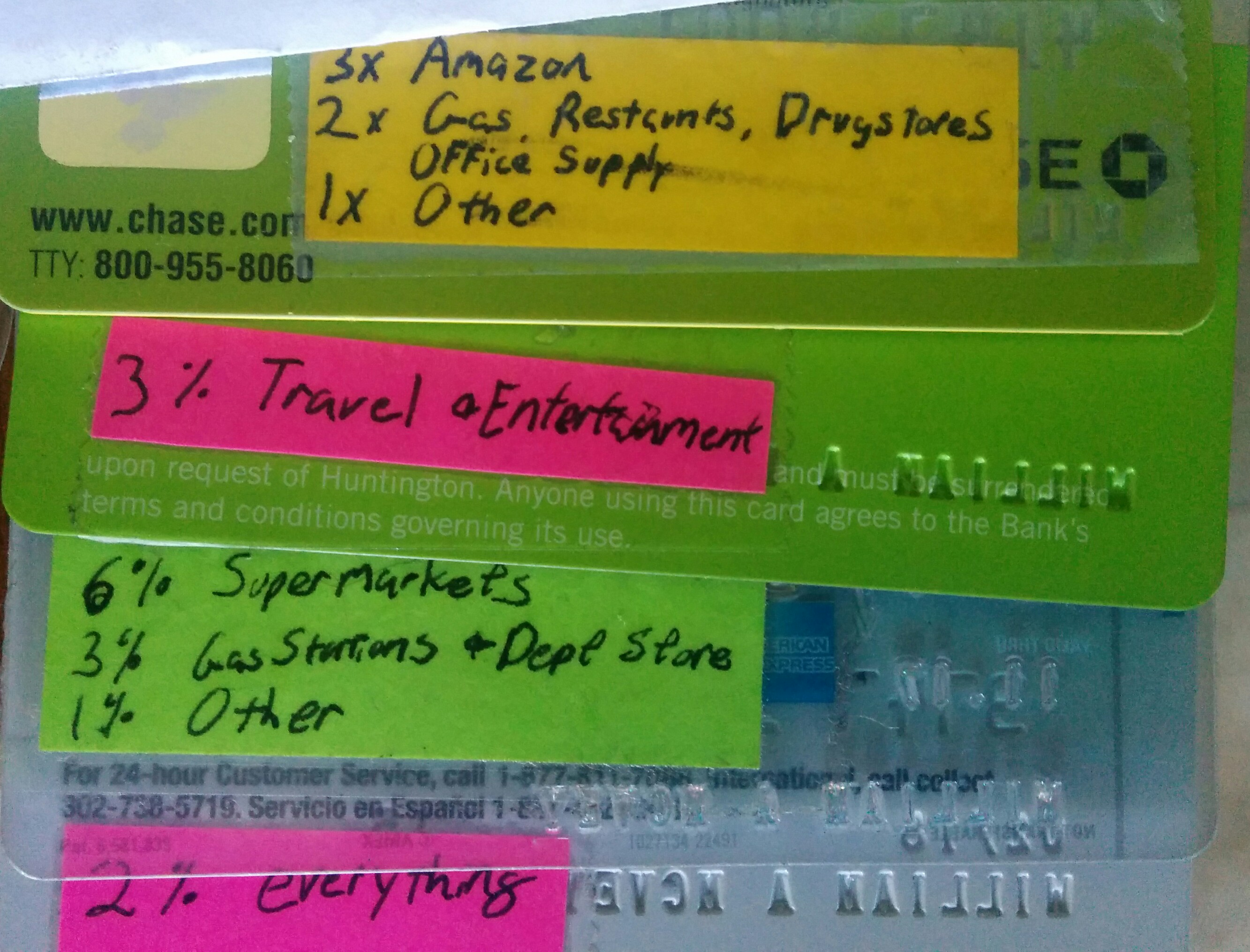

Keeping track of what card provides which bonus might be confusing if I had to keep track of it in my head. To avoid this, I simply let the card itself remind me what it is to be used for using some paper that gets taped to the card.

Any cards you guys like that I missed? I know some people make good use out of airline point cards to buy flights. This can perhaps score a higher return, but I just don't buy enough airline flights to really put this perk to good use.

More articles coming in my series of personal finance topics.

My Intro to Personal Finance and Investing

Around the turn of the year, a blog article caught my eye which included a list of 10 things to do related to one's personal finances at the turn of the year. One of the suggestions was to research all of my holdings to find the expense ratios and figure out exactly how much I was spending on my investments. Well, I decided to do this and set up a spreadsheet to help me track the expenses and such. Man was I shocked... astounded actually. I'd never really paid that much attention to my investments (that was what I was paying my Edward Jones financial planner to do after all). I'd spent the prior couple of years trimming the fat in the household's day to day operations. I'd switched phone service to a cheaper option, cut the cable service, started cooking at home a lot more. I was no spendthrift, but I had decided to try to be at least a little more frugal. I was incredulous when I saw how much money I was spending on the investments I was in. The fact is, since I never really saw a bill for those expenses, it was super easy to ignore.

Anyway, that all kicked off what has turned into a pretty passionate new hobby for me. And unlike most new hobbies that end up costing me money; this one has ended up both saving money as well as even making money. I fired my Ed Jones advisor and have taken a much more active role in charting my own economic future. I started reading books, blogs, forums, prospectuses, IRS tax code and more. I'm pretty happy with how things are looking for me, but the more I talk to friends and even passing aquaintences on forums, the more I realize that I am certainly not alone in my situation. I also found myself repeating a lot of the same good advice over and over. So, to avoid future repetition, I figured I'd make use of the new blog features of my website and start posting some of my lessons learned so that I can refer to people to them later.

I really don't have the desire to start writing a lot of original content to explain concepts or to paraphrase what I've learned from others. I'm also not doing anything really that is particularly innovative, so my posts on these topics will likely be mostly referring folks to other resources with perhaps some personal commentary. My current thought is that I'll probably post content on the blog, with the Personal Finance category set. I'll also try to link the post into a master index of personal finance topics I'll maintain.

PyCon 2015 notes posted

TL;DR: My PyCon 2015 notes as an exported mindmap

For roughly the past 10 years, I've been attending the US PyCon conference. This is my favorite conference series of all the various tech conferences I've been to (including: OSCon, Usenix, Blackhat/DefCon, CanSec, SAGE, Strata, Network World/Interop, and others). While at PyCon (and other conferences, for that matter), I try to take decent notes. My note taking tool of choice is FreeMind (XXX: perhaps a blog on why Freemind will be forthcoming). So my conference notes generally are in the form of mindmap documents.

Anyway, the conference notes for PyCon 2015 (Montreal) are now posted. I've exported the mindmap into a variety of formats, including:

First and foremost, these notes are meant for my own use, so if the presenter talked about content that I well understood I might not have put the effort into taking notes. Conversally, if a presenter talked about a topic I might not have known very well, the notes might not have gotten recorded if I got lost. Or, perhaps I just got sidetracked by the conference twitter and/or irc feeds...

pyoh.io now registered

After a night out on the town in Montreal last night, I had the opportunity to chat with Asheesh Laroia about a variety of topics (including the very cool project/company Sandstorm). Among the other topics we discussed, he pointed out that PyOhio actually ends with io and that it would be cool if the conference had the domainname pyoh.io. He was obviously right, so I went ahead and registered the domain and have set up some redirects to pointing to the official website. I'm also exploring some other cool things we can do with it.

ls_display posted to github

I've decided I'm going to start treating more of small utilities I use as real projects. One of these small little utilities is ls_display, a tool I use to take a stream of input (stdin) and output it in columns, similar to how the UNIX ls(1) displays file lists. Notably, this means dynamic number of columns, width of columns, and the rendering of data vertically down columns rather than just horizontally across tabstops.

Yet another new Wamber.net

I've quite literally lost track of how many iterations of wamber.net there have been. I'm now writing off the the prior version of the site as a complete disaster. The use of a content manager to manage my personal site seemed like a good idea at the time; but not only did it not accomplish the goal of a CMS (making the site easier to use); it actually impared my use of the site. It's pretty embaressing how little I actually I used my site while it was configured with a CMS. My workflow is much more aligned to writing my thoughts down in a text document using my favorite editor than writing content into a text widget. Consequently, the tool I chose to help me manage the site kind of did the job, but only because I avoided using the site and thus didn't have anything to manage.

So, for iteration n+1, I'm going old school and adopting a static website. I'm now using the nikola static blog generation software. I think this probably is more in line with how I generally want to use the site. Write some ideas down in a text file and publih them in a way that can actually be well integrated into a website. We'll see if this reduction of complexity actually ends up improving the usability of my own site.